Before you submit another credit card application, be aware of three ways in which opening a new credit card negatively affects your credit score. This knowledge may lead you to decide against establishing a new credit card account.

A new credit card might boost your credit score if it is your first one or if you had little credit history before opening the account. You might not have had a credit score at all before getting your first credit card. Within six months of opening the account, however, there should be enough information to generate a credit score for you.

In other circumstances, opening a new credit card account could hurt your credit score, at least in the short term.

Lowers Your Average Credit Age

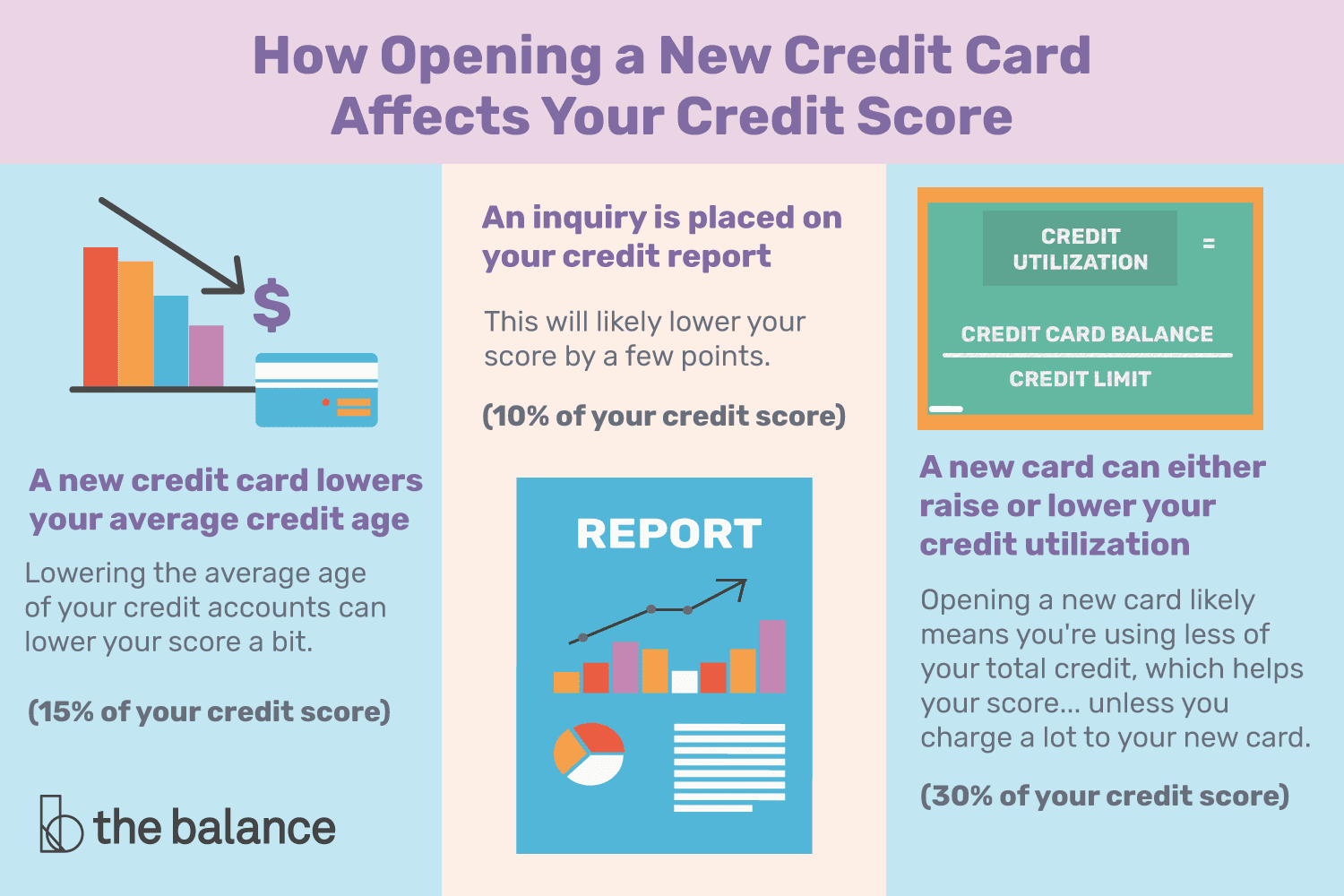

Fair Isaac Corporation (FICO) uses five factors to calculate your credit score, and your credit age makes up 15% of the score. This measures the amount of experience you have using credit. Generally, the more experience you have, and the older your accounts, the better your credit score will be.

There are three factors to your credit age: the age of your oldest account, the age of your newest account, and the average age of all your accounts. Opening a new credit card account lowers the average age of all your accounts, especially if it’s been a while since you last opened a credit account. If you have many accounts and a long history, one new credit card will have minimal impact, but if you have only a few accounts on your record, a new credit card will bring down the average age of your accounts considerably.

A Hard Inquiry

A hard inquiry is placed on your credit report when you apply for a new credit card, even if you’re not approved, and even if you later decide not to accept the credit card. Hard credit inquiries show that a business has checked your credit report to review your credit for an application you have made.

Numerous hard inquiries in a short period of time look bad on your credit report, because they give the impression that you are looking to do a lot of borrowing in a short period of time or that you might be desperate for credit.

Inquiries make up 10% of your credit score. Depending on the other information in your credit report, an additional inquiry could cost a few credit score points. It may not sound like much, but those few points could lead to a higher interest rate.

Increased Credit Utilization

Opening a new credit card could also raise your credit utilization if you make a big charge on it right away. For example, if you open a new store credit card and use it to make a large purchase on the same day, you’ll increase the percentage of available credit that you are using.

Your credit utilization is the ratio of your credit card balances compared to their credit limits. If you charge a balance that takes up too much of your credit limit, your credit score will take a hit. That’s because 30% of your credit score considers how much of your available credit is being used. The more of your new credit limit you’re using, the more your credit score will be hurt.

note

Store credit cards are tempting, because applying for one often leads to discounts on purchases. Store credit cards are also known for their low credit limits, so a large purchase could spike your credit utilization instantly.

Positive Effects

In some cases, opening a new credit card can improve your credit score. If you don’t make any new purchases on your credit cards, including the new one, your overall credit utilization will drop, and your credit score could increase.

You could increase your score by increasing the types of credit on your account, especially if you don’t already have a credit card. Having a variety of types of credit shows that you can handle different loans, and this represents another 10% of your credit score.

note

Opening a new credit card and using it wisely can help boost your credit score in the long run, especially if you have damaged credit and need a positive payment history to offset past delinquencies.

Be sure that you charge only what you can afford to pay on your new credit card, and always make your monthly payments on time. You should always open new credit cards on an as-needed basis rather than opening one simply to attempt to boost your credit score.

Frequently Asked Questions (FAQs)

What is a good credit score?

Credit scores range from 300 to 850. A score from the mid to high 600s is usually considered to be fairly good. A score of 800 or above is considered to be excellent. Creditors decide what scores they’ll accept for applicants, however. Scores that are fair or even poor might be accepted, depending on the product and the creditor.

How can I improve my credit score?

You can improve your credit score by addressing the issues that affect it. Payment history makes up 35% of your credit score, so bring delinquent accounts up to date first if you’re behind on any payments or have accounts in collections. Amounts owed make up 30% of your credit score, so do your best to pay down your balances. Check your credit report to ensure that it doesn’t contain any errors, like accounts that don’t belong to you.